Article written by Rishabh Dev under the guidance of Alejandro Velez, former ML and Data Engineer and instructor at Interview Kickstart. Reviewed by Swaminathan Iyer, a product strategist with a decade of experience in building strategies, frameworks, and technology-driven roadmaps.

With the emergence of artificial intelligence (AI) and Generative AI (Gen AI), the financial landscape is changing rapidly, driven by the need for efficiency, accuracy, and data-driven decision-making. Companies are now seeking to automate complex processes, reduce operational costs, and deliver superior customer experiences. As a result, financial AI agents have become game-changing solutions.

Integrating AI agents in financial services helps finance companies in analyzing large amounts of transactions and data. Currently, the financial services industry is undergoing rapid transformations through AI and is entering an era of change, which is defined not just through Gen AI but also by AI agents.

This blog explains step-by-step how to build financial AI agents with a leading workflow automation platform – n8n.

Key Takeaways

- Financial AI agents are intelligent virtual assistants that automate tasks like data analysis, fraud detection, and portfolio management in the financial sector.

- You can build financial AI agents either by using code-heavy frameworks like LangChain or by using low-code tools like n8n for faster, no-code development.

- Building a financial AI agent with n8n involves setting up triggers, configuring AI models and tools like Browserless, Notion, and Discord, and clearly defining the agent’s goals and logic.

- Avoid common mistakes such as poor data security, lack of testing, ignoring regulations, or over-relying on AI without human oversight.

- n8n AI agents have real-world use cases across fraud prevention, customer service, compliance, portfolio management, and credit processing, offering major efficiency gains.

What are Financial AI Agents?

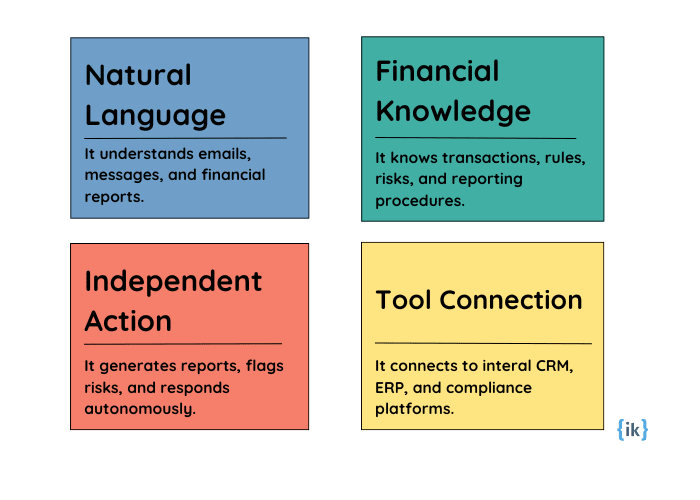

A financial AI agent is a highly intelligent and autonomous software entity that interacts with financial data and systems. It uses large language models (LLMs), financial APIs, databases, and customer rule sets to automate different tasks that typically require human reasoning or judgment.

However, you cannot think of financial AI agents as just helpdesk tools. They can navigate financial data, detect issues, and act autonomously.

Before building financial AI agents, you should consider them as virtual financial assistants that:

- Understands goals

- Use data from different sources

- Reasons through internal logic, memory, and LLM capabilities

- Executes tasks

- Learns and adapts

Commonly Used Methods for Building Financial AI Agents

Financial AI agents can be developed through two common methods: by using existing frameworks and by using workflow automation tools. Let’s understand them in more detail below:

Using Existing Frameworks

One of the most effective ways of building financial AI agents is by using already existing frameworks like LangChain, Auto-GPT, OpenAI, and more. These enable the developers to develop complex AI agents using coding languages such as Python, JavaScript, and more. The following table shows the pros and cons of using these existing frameworks.

| Pros | Cons |

| Fine-grained control | A strong programming language is required |

| High customizability | Has a slower time to market |

| Suitable for large-scale enterprise apps |

Using Workflow Automation Tools

To build financial AI agents, you can use workflow automation tools through platforms like n8n, Zapier, or Make. You can take advantage of using visual workflows and pre-built integrations. The following table shows the benefits and limitations of using this method.

| Pros | Cons |

| No-code/low-code experience | Lacks deep model customization |

| Faster deployment | Limited in scaling complex logic |

| Easy integration with APIs, CRMs, and financial systems |

Step-by-Step Tutorial for Building Financial AI Agents with n8n

Having understood the commonly used methods for building financial AI agents, let’s dive into building one using n8n, a low-no-code/low-code platform. This tutorial will take you through the steps of building a comprehensive financial AI agent capable of performing several tasks.

Prerequisites

Before understanding the process and steps involved in building financial AI agents, there are some prerequisites that you must be aware of:

- n8n instance: You need to create an account on n8n and have it properly set up. You can even self-host using applications like Docker. An n8n cloud account can also be helpful.

- Browserless: To build a financial AI agent, a Browserless instance is required. It will perform web scraping. You can either self-host your own instance using applications like Docker or use Browserless’s cloud services.

- Google AI API Key: Next, you need Google AI Studio’s API key to use Google Gemini.

- Discord: The last prerequisite is to have a Discord webhook or a bot account that can send notifications when the research is done.

Step 1: Set up the trigger

The first step in setting up any n8n workflow is to set up a trigger node. When a specific event occurs, this node starts the workflow. For example, for an AI research agent, the workflow can be triggered when a message is sent to it with a URL through a chat interface.

In the n8n canvas, click on the ‘+’ button to add your first node and select a trigger that aligns with how you want to interact with your AI agent. In the example of the AI research agent, you can use the chat trigger to start the workflow.

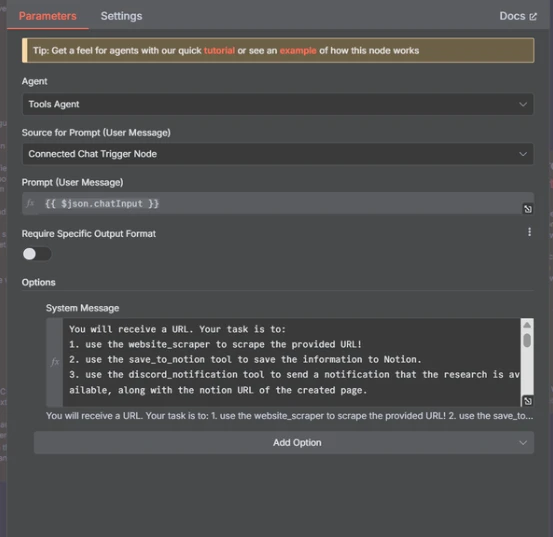

Step 2: Configure the Agent’s core

The next step involves setting up the AI agent’s core. It is the heart of the workflow and acts as a central command, connecting the trigger, the large language models (LLMs), and the tools.

To do this:

- Add an AI agent node to the canvas

- Connect the output of the trigger node to the input of the AI agent node

- Ensure ‘Tools Agent’ is selected from the ‘Agent dropdown’ in the AI agent node settings. It ensures that the agent uses the specified tools to perform the tasks

- Set the ‘Source for Prompt (User Message)’ to ‘Connected Chat Trigger Node’ to tell the agent to use the input from the trigger.

Step 3: Define the Agent’s goal and instructions

In the next step, you give instructions to the AI as to what you want it to do and how to use the given tools. Giving clear and specific instructions is critical to ensure reliable performance from the AI agent.

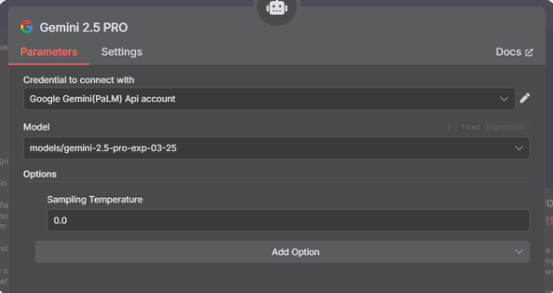

Next, you have to add a Google Gemini chat model node (or any other LLM node that you prefer) and configure it using your credentials or the API key.

Select your desired model and connect the LLM node to the chat model input of the AI agent node.

- While in the AI agent node parameters, open the field named ‘System Message’ from the ‘Options’ section to provide the core instructions for the AI agent. Here, you will give instructions to the agent. Keep in mind the following while instructing the agent:

- Clearly state tasks to the agent

- Instruct the agent on when and how to use the tools

- Add any essential commands like “Remember you always have to scrape the website using the website_scraper tool”, or any other

Step 4: Add the web scraping tool

Now, you can configure the tools that the financial AI agent can use. The web scraper uses Browserless, and since there is no dedicated node for it, you can use the ‘HTTP Request Tool’ node. After adding this node, rename it to ‘website_scraper’ or anything similar. Ensure that this name matches the tool name used in the financial AI agent’s system message.

Use the following to configure the node:

- Method: POST

- URL: Enter your Browserless API endpoint for scraping content

- Authentication: Configure if required by your Browserless setup

- Body: Using JSON Below

- JSON: Provide the JSON payload Browserless expects. Use a placeholder for the URL the agent will provide:

{

“url”: “{url}”,

“gotoOptions”: {

“waitUntil”: “networkidle0”

}

}

- Placeholder Definitions: Define the placeholders used in the JSON body

- Click Add Definition

- Placeholder Name: url (must match the placeholder name in the JSON body and the parameter name expected by the AI Agent)

- Description: Provide a clear description for the AI (e.g., “the URL of the website to scrape”)

- Type: String

Finally, you have to connect the ‘HTTP Request Tool’ node (website_scraper) to the Tool input of the AI Agent node.

Step 5: Define the save to Notion tool

The next step involves configuring the tool to save the scraped and summarized data to your Notion database.

For this, you have to add a ‘Notion Tool’ node in the canvas and rename it as ‘save_to-notion’, ensuring it matches the tool name from the system message. Then, under the ‘Tool Description’ option, select ‘Set Manually’ and add a description in the next box.

Then select your configured Notion API credentials to authenticate Notion. In the ‘Resource’ box, select ‘Database Page’ and under ‘Operations’, select ‘Create’.

After this, select your target Notion database and ensure that then8n integration has access to it and contains all the required properties like name, URL, description, tags, etc. as you defined during the setup.

In the ‘Properties’ tab you will have to map the data generated by the AI agent to your Notion database fields. Further, for each of the properties like ‘Title’, ‘Description’, etc, use the {{$fromAI(‘parameterName’, ‘Description’, ‘type’) }} expression. Then replace the ‘parameterName’ with the exact parameter name you had defined in the system message of the AI agent.

Step 6: Define the Discord notification tool

To ensure the AI agent can report its task completion, we’ll equip it with a tool for sending Discord messages. This allows the agent itself to decide when and how to notify you based on its instructions and the outcome of its tasks.

Add a Discord Tool node, name it “discord_notification,” and select your Discord Webhook or Bot credentials. Select Send a Message in the Operation dropdown. Here we will prompt the AI agent to craft the notification message, for example: {{ $fromAI(‘Message’, ‘Confirmation that research was done along with the URL to the notion page where the research is now available.’, ‘string’) }}. And optionally in the Embeds field, we can embed a link for a richer notification by including the title and URL to the newly created Notion page.

Step 7: Test and refine your AI agent

Make sure to save the workflow and send a chat message containing a URL you want researched. Observe the workflow execution in the n8n UI, checking the input/output of each node, especially the AI Agent node, to see how it processes the request and which tools it decides to call.

Verify that the website was scraped correctly, check that a new page was created in your Notion database with the expected content and summary, and that you received a notification in Discord.

If the agent doesn’t perform as expected, check each node and tool output, looking for reasoning or any errors in tool calling. Modify the instructions in the System Message, make the instructions clearer, add constraints, or refine the parameter definitions. Then save, and test again until the AI Research Agent reliably performs the desired scrape, summarize, save, and notify tasks.

Common Mistakes to Avoid When Building Financial AI Agents

Building n8n financial AI agents requires careful attention to detail and awareness of potential pitfalls. Here are critical mistakes to avoid:

Data Security and Privacy Violations

Mistake: Storing sensitive financial data without proper encryption or access controls.

Solution: Implement end-to-end encryption, use secure API keys, and follow data minimization principles. Ensure compliance with regulations like PCI DSS, GDPR, and local privacy laws.

Inadequate Error Handling

Mistake: Not implementing comprehensive error handling and fallback mechanisms.

Solution: Create robust error-handling workflows, implement retry logic for API failures, and set up human escalation procedures for critical issues.

Ignoring Regulatory Compliance

Mistake: Building agents without considering regulatory requirements and compliance obligations.

Solution: Consult with compliance experts, implement audit trails, and ensure all automated decisions can be explained and justified.

Poor Testing and Validation

Mistake: Insufficient testing with real-world scenarios and edge cases.

Solution: Develop comprehensive test suites, conduct stress testing, and validate agent behavior with historical data.

Over-Reliance on AI Without Human Oversight

Mistake: Allowing AI agents to make critical financial decisions without human oversight.

Solution: Implement approval workflows for high-value transactions, set up monitoring dashboards, and maintain human oversight for critical decisions.

Inadequate Performance Monitoring

Mistake: Deploying agents without proper monitoring and alerting systems.

Solution: Implement comprehensive monitoring, set up performance alerts, and regularly review agent effectiveness.

Lack of Documentation and Maintenance

Mistake: Poor documentation and insufficient maintenance planning.

Solution: Create detailed documentation, establish regular maintenance schedules, and plan for system updates and improvements.

Use Cases for Financial AI Agents

N8n AI agents can be applied across numerous financial scenarios:

Fraud Detection and Prevention

- Automated Transaction Monitoring: AI agents continuously analyze transaction patterns, flagging suspicious activities based on user behavior, transaction amounts, and geographical patterns. They can automatically freeze accounts, send alerts, and initiate investigation workflows.

- Real-time Risk Assessment: Agents evaluate transaction risk in real-time, considering factors like merchant reputation, transaction history, and user location to prevent fraudulent activities before they occur.

Customer Service Automation

- 24/7 Support: AI agents handle routine customer inquiries, account balance requests, transaction history queries, and basic troubleshooting, providing immediate responses outside business hours.

- Personalized Financial Advice: Agents analyze customer financial data to provide personalized recommendations for savings, investments, and financial planning.

Portfolio Management

- Automated Rebalancing: AI agents monitor investment portfolios and automatically rebalance holdings based on predefined strategies, market conditions, and risk tolerance.

- Performance Reporting: Agents generate detailed portfolio performance reports, comparing against benchmarks and providing insights for investment decisions.

Compliance and Regulatory Reporting

- Automated Compliance Monitoring: Agents continuously monitor transactions for compliance violations, automatically generating reports for regulatory authorities and flagging potential issues.

- KYC/AML Processing: Agents automate customer verification processes, screening against watchlists, and maintaining compliance documentation.

Credit and Loan Processing

- Automated Credit Scoring: AI agents analyze credit applications, assess risk factors, and make lending decisions based on predefined criteria and machine learning models.

- Loan Servicing: Agents handle payment processing, send payment reminders, and manage delinquency workflows.

- Market Analysis and Trading

- Algorithmic Trading: Agents execute trading strategies based on market analysis, technical indicators, and predefined rules.

- Market Research: Agents gather and analyze market data, generating insights and recommendations for investment decisions.

Accelerate Your Learning with Interview Kickstart’s Financial AI Agent Masterclass

While this guide provides a comprehensive foundation for building financial AI agents with n8n, mastering the intricacies of agentic AI for financial services requires expert guidance and hands-on experience. Interview Kickstart’s Financial AI Agent Masterclass offers an intensive, practical learning experience designed for professionals ready to advance their careers in financial technology.

Led by industry veterans who have built and deployed AI agents for financial services at scale for Fortune 500 financial institutions, the masterclass focuses on building actual financial AI agents, including fraud detection systems, compliance monitoring agents, and portfolio management tools that you can showcase to potential employers.

The financial AI revolution is creating unprecedented opportunities for skilled professionals across software engineering, financial analysis, product management, and data science roles. Whether you’re building n8n financial AI agents for the first time or looking to advance to more sophisticated enterprise implementations, the Financial AI Agent Masterclass provides the expertise, hands-on project portfolio, and career coaching needed to succeed in this rapidly evolving field, with lifetime access to materials and ongoing support for career advancement.

Conclusion

Building financial AI agents with n8n represents a powerful approach to modernizing financial services operations. The combination of n8n’s user-friendly workflow automation capabilities with advanced AI processing creates opportunities for organizations to develop sophisticated, intelligent systems without requiring extensive technical expertise. The key to successful implementation lies in careful planning, thorough testing, and continuous optimization to create AI agents that enhance efficiency, improve customer experiences, and maintain regulatory compliance.

FAQs: Financial AI Agents

1. What is the difference between traditional automation and AI agents in financial services?

Traditional automation follows predetermined rules and workflows, while AI agents can make intelligent decisions, learn from data, and adapt to new situations. Financial AI agents can understand context, reason through complex scenarios, and provide personalized responses, making them more suitable for handling diverse financial tasks.

2. How secure are n8n financial AI agents for handling sensitive financial data?

N8n financial AI agents can be highly secure when properly configured. Security measures include end-to-end encryption, secure API management, access controls, and audit logging. However, security depends on proper implementation, regular updates, and adherence to financial industry security standards.

3. What are the costs associated with building financial AI agents using n8n?

Costs vary based on complexity and scale but typically include n8n licensing (free for self-hosted), AI service costs (like OpenAI API usage), infrastructure costs, and integration fees for financial APIs. The low-code approach generally reduces development costs compared to custom programming solutions.

4. Can small financial institutions benefit from AI agents, or are they only suitable for large banks?

AI agents for financial services are scalable and can benefit organizations of all sizes. Small institutions can start with simple use cases like customer service automation or basic fraud detection, then expand capabilities as they grow. The no-code approach makes AI agents accessible to smaller organizations with limited technical resources.

5. How long does it typically take to build and deploy a financial AI agent with n8n?

Development time varies based on complexity, but simple agents can be built in days or weeks, while comprehensive systems may take several months. The visual workflow approach significantly reduces development time compared to traditional coding methods.

6. Do I need programming skills to build financial AI agents using n8n?

No, n8n is a low-code platform, so you can build powerful AI agents using its drag-and-drop interface with minimal coding. However, basic logic and API knowledge can enhance your workflows.

7. Can financial AI agents be integrated with existing banking systems?

Yes, AI agents in n8n can connect with existing banking CRMs, databases, and APIs. This allows seamless integration without overhauling current systems.

8. What are the limitations of using n8n for financial AI agents?

n8n may have limitations when handling highly complex logic or deep model customization. For advanced use cases, combining n8n with traditional frameworks may be required.

9. How can I monitor the performance of my financial AI agent?

Use n8n’s execution logs, add monitoring nodes, and set alerts to track performance and spot errors. Regular testing ensures continued reliability and efficiency.

10. Can n8n financial AI agents be updated or improved over time?

Yes, n8n workflows are fully editable, so you can update instructions, add new tools, or change triggers as your needs evolve or business logic changes.